Real estate sales in Summit County

There are a lot of good signs in the economy, both nationally and locally, that will lead to a strong market in 2026.

How much does a house in Breckenridge cost?

There are many properties for sale in and around Breckenridge. These include condos, townhomes, duplexes, and single-family residences of varying sizes and rates. A single-family home in Breckenridge can cost anything from $799,000 to more than $21 million. Many homes have prices of more than $3 million, and many of them have lots of land. Condos cost from $385,000 to $4.495 million. Some condos in Breckenridge are ski-in, ski-out, and most include resort-style features like pools, hot tubs, and exercise facilities. You can also buy land and put a house on it. Are you looking for a new place to call home? Look through the houses that are now for sale in Breckenridge, Colorado. Take a look at the Breckenridge real estate market trends, like the average price of homes, townhomes, condominiums, and other types of property. You can also see properties that are for sale and those that have already sold. I hope that you are all having a wonderful Holiday Season! We have gotten some great snowfall in the past week so the skiing is getting better and better. If you come to visit let me know and we can meet up and talk about Real Estate and what is going on in the market.

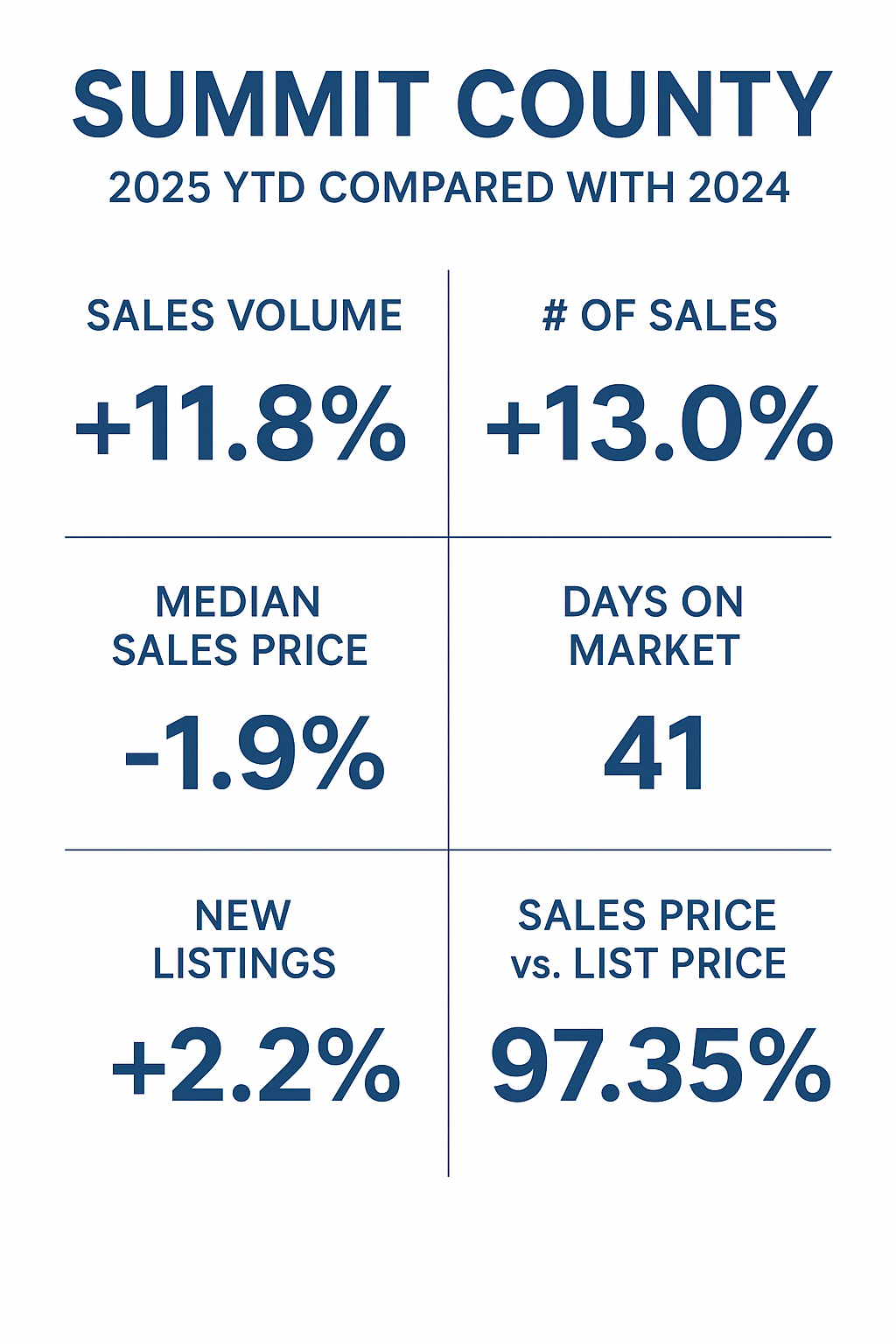

Sellers; if you are thinking about selling soon give me a call. I can take a look at your property to see what needs to be done to get the property on the market. With my experienced staging skills, understanding of the market trends and successful pricing strategies I can guide you through the process of selling with ensuring that you will maximize your investment. If the home needs some updating to get it ready for optimal showings my remodeling crew can get your property ready to go in short order once you are ready to pull the trigger. The stats for all of Summit County for 2025 YTD compared with 2024 are as follows: Sales Volume is up +11.8%, # of Sales are up +13.0%, Median Sales Price is down -1.9%, Days On Market is up to 41 days, New Listings are up +2.2% and the Sales Price versus the list price is coming in at 97.35%.

Buyers; if interest rates continue to slowly be lowered the market will quickly shift from a semi Buyers Market to a Sellers market again. This will create less inventory and higher prices. Get in before this happens while Buyers have a bit of an advantage. Give me a call now to start the search early so that as properties come on the market in the spring you will have your market knowledge in place and can move quickly.

Whether you are a Seller or a Buyer you may both find that this is a good time to optimize your investment dollars so give me a call. My Experience working with Sellers and Buyers is extraordinary and I will be able to help you through your Real Estate Transaction as a stress free and fun process!

Click on the link below to view this weeks wonderful New Listings. If you see something that catches your eye give me a shout. I am always here to help!